Can I Fill Out a 1099 by Hand?

Though information technology's tempting to try, y'all probably can't handle every aspect of running your business in-house. Only considering yous can brand the best pancake bun pineapple burgers in the Midwest doesn't mean you can brand a good website or keep upwards with day-to-solar day bookkeeping.

These tasks demand to be done, though, and while your business is growing, you may non accept room in the budget for a full-time employee, and so you might hire an contained contractor. At the end of the year, you lot'll need to fill out a 1099-NEC course to send to those contractors and the IRS.

Read on to larn about the departure between a contractor and an employee, how to consummate the course, and where to send it when it's done.

Overview: What is a 1099-NEC form?

The 1099-NEC form is the contained contractor revenue enhancement class. Use it to report to your contractors, and to the IRS, how much they were paid over the grade of the tax twelvemonth. Y'all only need to file 1099s for contractors who earned more $600.

The 1099-NEC grade was reincarnated in 2022 (it had originally been abased in 1982) to report payments made to individuals. Prior to 2020, those payments were reported on the 1099-NEC.

Who is responsible for preparing a 1099-NEC?

The payer is responsible for completing the 1099 tax form and sending it to the IRS and the contractor. If your business hires contractors to perform tasks, yous will need to complete the class at the end of the tax twelvemonth.

If you are paid as a contractor by one or more of your clients, y'all volition receive the 1099-NEC, but you practice not need to send it to the IRS. However, you do need to report the income on your pocket-sized business taxes.

If yous practice non receive a Form 1099 from a customer, the income still should've been booked to revenue when information technology was earned.

How to file a 1099 course

Here are the steps to completing and submitting the 1099-NEC grade.

Step 1: Decide who is a contractor

The outset pace is determining which of the people you work with are contractors and which are employees. This amounts to a 1099 vs. W2 tax course determination, since independent contractors receive 1099s, and employees receive Westward-2s.

Independent contractors generally work for a business only exist separately from it. They set their ain fiscal statements, pay their own FICA taxes, set their ain work hours, and work on specific projects. Employees, on the other hand, are fully integrated into a business organisation' operations.

It may be tempting to consider employees contractors to avoid paying the employer portion of FICA taxes. The IRS is aware of this temptation and closely tracks contractor payments. It will be ane of the kickoff things the IRS looks at in an audit, and you could be on the hook for thousands in back payments and penalties if you lot break the dominion here.

If yous're not certain, complete the IRS Form SS-8. In it, y'all volition describe the work relationship, and the IRS will determine whether to classify the person every bit a contractor or an employee. It could take up to six months for the form to be returned, then it's best used in situations where in that location volition exist a long-term piece of work human relationship.

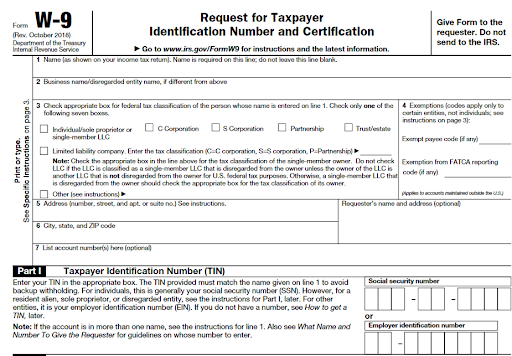

The best way to avoid stressful, last-minute decisions is to determine how to classify new people when they are hired. Send an IRS form W-9 to people who will be independent contractors. Information technology asks for the info y'all need for the 1099.

Step two: Order forms

You volition demand to lodge the IRS form 1099s and then print out the information on them. You tin either gild the forms from the IRS or from your tax software, which volition as well be helpful in completing the forms.

Pace 3: Consummate forms

We'll go over the general 1099 requirements here. For more unique cases, reference the IRS 1099-NEC instructions.

Allow'south start with the information on the W-9.

The W-9 will allow you know the contractor's legal proper noun, EIN and address. Source: irs.gov.

The West-9 is where yous volition discover the legal name, address, entity type, and contractor EIN. If they are registered as an Due south corporation or C corporation, no 1099 is required. Enter this information into your accounting software and you tin can export it onto the 1099.

Onto the 1099-NEC.

Copy A of the 1099-NEC is sent to the IRS. Source: irs.gov.

You should receive four versions of the higher up form to be printed out for each contractor. Ane is for the IRS, two are for the contractor (i for their file and i they may need to submit to their land government), and 1 is for your file. Each version is completed with the same information. The IRS version is printed in red.

Start with the income corporeality in Box one. Recall you only demand to complete the form if you paid more than than $600 to the contractor during the year. Check Box 2 if you lot purchased more than $5,000 in consumer products (due east.yard., t-shirts, jail cell phone cases, books, etc.) for resale from this contractor. Brand certain to report the sales amount on your concern's income tax return.

Revenue enhancement withholding, reported in square 4, is only required in rare situations, similar for migrant agricultural workers who do not have a taxpayer identification number (Tin can). See the instructions above if you retrieve you may have to withhold taxes.

Finally, complete Form 1096, which is a summary of all 1099s. Your taxation or accounting software should generate this form automatically.

Pace four: Mail forms

The forms can either exist submitted electronically or mailed. To file Re-create A electronically, first submit Form 4419 to get a Transmitter Control Code (TCC). The TCC tin can and so be used to create an business relationship with the IRS Filing Data Returns Electronically (FIRE) system.

The address for mailing Copy A along with the 1096 summary form varies by state.

Transport the recipient copies of the course to contractors for their reporting.

Step 5: File forms

Browse the 1096 with all of the 1099s, and salvage the electronic file for future reference. It is a good exercise to keep the saved grade for iii to five years. If you receive a 1099 from your clients, this should also exist saved for three to five years.

When are 1099s due?

The IRS 1099 rules dictate that 1099s must be filed with the IRS and mailed to contractors by January 31. Your contractors need time to process their 1099s to file their own business tax return.

If yous are coming upwardly on the deadline and won't be able to meet information technology, you lot can request an extension from the IRS directly. You won't get much additional time, probably simply 30 days, and the extension will be declined if you file it after the due engagement.

If y'all do non file on time, you will exist fined per return and the penalty increases with each month that you do non file.

You would likewise need to request an extension for the recipient re-create. Send a letter to the IRS at the following address:

Internal Revenue Service

Attn: Extension of Time Coordinator

240 Murall Drive, Mail Finish 4360

Kearneysville, WV 25430

Per the IRS full general instructions, the following data must be in the letter, "(a) payer name, (b) payer Tin can, (c) payer address, (d) type of return, (due east) a statement that extension asking is for providing statements to recipients, (f) reason for filibuster, and (g) the signature of the payer or authorized agent."

Exercise your 1099s the easy manner

Completing and sending 1099s is an important part of the business organization tax wheel — the IRS and your contractors will not be happy with late or inaccurate data. If you merely have a few contractors, information technology is easy enough to complete the forms manually.

If yous use a lot of contractors, just keep your accounting up to date throughout the year, and let your software do the piece of work in January.

The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.

pattonsabighter79.blogspot.com

Source: https://www.fool.com/the-blueprint/1099-misc/

Post a Comment for "Can I Fill Out a 1099 by Hand?"